The get car insurance quotes blog 8470

AboutSome Known Questions About Cheap Car Insurance - Affordable Auto Insurance Company.

When an insurance provider insures your vintage car, they presume that this automobile will receive unique treatment. Like any sort of collector's product, your classic automobile is something that is offered exceptional attention and care. To ensure that the lorry is being well-taken care of, vintage car insurance providers have particular limitations or restrictions that they put on making use of the automobile.

Lots of insurance provider will restrict the time of day that the automobile can be driven and will specify the hours you are permitted to have your vintage car on the road. Most vintage car owners just utilize their automobiles for special occasions like going to car shows, driving in parades, or going to classic cars and truck club activities.

Because of the minimal usage of the automobile, the insurer will likely have constraints on the number of miles you can place on your car every year. Numerous classic automobile insurance providers will require that you only drive your lorry to automobile exhibits, parades, and other traditional car-related activities. Your insurer will inform you what usages are acceptable for your policy.

An Unbiased View of The True Cost Of Owning A Car - Credit Karma

If it hasn't been customized, you will just require images of the beyond the car and the engine. Other important info that your agent will require is the model, make, and year of the car, in addition to the automobile's mileage. Beyond information about the vehicle, your representative will require information about the motorists that will be noted on the policy.

These companies specialize in the protection you need. We're looking forward to hearing about your piece of history and seeing images of your timeless automobile.

Whether you're new to the state and trying to find vehicle insurance coverage, or you have actually resided in California for years and wish to find the very best cheap vehicle insurance coverage in California, without skimping on coverage, you'll find the info you require here. This guide to from our veteran personnel of insurance coverage analysts and editors.

The Only Guide for Car Insurance - Auto Insurance - Mercury Insurance

You'll discover just how much protection to buy, just how much it will cost, and find out how auto insurance coverage in California works to safeguard you and your family. Secret Emphasizes, The average cars and truck insurance rate in California is California is the seventh most pricey state for auto insurance in the nation, its average rate is $367 more a year than the across the country average annual rate of $1,758.

California is one of a couple of states in which your to determine rates. California vehicle insurance coverage laws likewise include a collision deductible waiver option, a mandatory excellent motorist discount for qualified motorists, a low-income option for qualified motorists, vary from other states because your location is not weighted as much in prices policies and is among the 13 states that have a pure relative fault rule.

California insurance provider primarily element in the number of years you've been driving, your driving record and how lots Browse this site of miles you drive when deciding how much you pay. However every company utilizes its own technique for examining danger. That's why the expense for the same policy can vary substantially among insurance provider and why you must compare rates.

The Of Paying Less For Car Insurance Could Actually Cost You More ...

You'll see that the difference between the highest rate and the most affordable in the table listed below is $1,320, on average, according to Cars and truck, Insurance coverage. State Farm is the least expensive car insurance coverage company for young motorists and students in California buying a complete coverage policy.

But even young chauffeurs in California can save money by comparing auto insurance coverage rates to see which company has the most affordable rates, by getting approved for student discounts, and by remaining on their moms and dads' policy as long as possible. Geico is the cheapest for senior motorists with a typical cost of $1200 a year in California.

Some drivers want to pay a bit more for outstanding customer support, some want the most affordable rates, while others prefer providers who can manage claims and payments through mobile apps, some prefer agents. Determining finest automobile insurance coverage in California, To identify the, we evaluated top carriers in the state and ranked them on claims, customer fulfillment, financial strength, online shopping and cost.Car, Insurance coverage.

Getting My How Much Is Car Insurance In 2021? - Motor1.com To Work

A.M. Best monetary ratings reveal a company's capability to meet its financial commitments. In the 2021 J.D.

Auto Insurance VehicleInsurance Coverage Research study received top got leading the best car finest automobile Insurance coverage for customer satisfaction. Geico had the most affordable rates amongst the best insurance coverage companies in California surveyed for vehicle insurance expenses, it had the highest problem ratio.

The Greatest Guide To Average Car Insurance Cost Per Month - Autoinsurance.org

Geico Deal hunters, as it has the most inexpensive rates overall for motorists in California, and is likewise most affordable for drivers with tickets and mishaps as well as senior vehicle drivers. It received a 4 rating from Car, Insurance coverage. State Farm Young motorists, teenager motorists and trainee motorists and those looking for special coverages and a terrific online shopping experience.

USAA had the greatest J.D. Power customer fulfillment score in the country (880) and likewise topped the list of finest insurance providers in Cars and truck, Insurance coverage. Military members can take advantage of specialized protection choices around release and storage, while likewise getting discount rates for low-mileage.

The Definitive Guide for Average Cost Of Car Insurance (October 2021) - Valuepenguin

Your age, your driving record, the model of car you have, the seriousness and frequency of claims in your community and other variables are used by companies to find out the cost of your policy. That's why the rate for the very same protection can differ substantially amongst insurer and why you need to compare rates.

https://www.youtube.com/embed/XDv6TK-f1mk

Maximizing discounts, for example bundling your house and car with the same company can save up to 12% on your automobile costs. Dropping comprehensive and collision for automobiles that deserve less than $3,000 Hiking your deductible amount, for example, from $500 to $1,000 postal code, Fundamental individual information name, age, birthday, Driving history, Present insurance provider, Information on other drivers in your household, Car make and model, Desired protection types, limitations, and deductibles, All cars VIN (car recognition number)If you own, lease or finance your lorry, Yearly mileage, All household driver's license numbers, Amount of time you have actually been insured, Once you provide the details, you will normally get a quote that is in numerous cases an estimate of what you will pay.

AboutMore About Brochure: Lowering Your Auto Insurance Costs - Kraft ...

Knowing how to save money on your vehicle insurance can save you lots of money each year, and these auto insurance expert suggestions can assist. 1. Pay for what you utilizeUsage-based insurance is one way to lower car insurance costs with a pay-as-you-drive format. It's an excellent option when you prepare for low mileage driving through the year.

Try to find discount rates, Many insurance coverage business offer automobile insurance coverage discount rates that you can utilize for regular cost savings on your vehicle insurance coverage premiums. Package discounts are popular, permitting you to conserve when you add multiple lorries from the same family or bundle your automobile insurance with your house owners insurance, occupants insurance, or life insurance coverage policy. Ask your insurance coverage company about discount rates you may qualify for. Improve your credit score and driving record, Automobile insurance companies typically utilize your credit score as one item of consideration when evaluating your threat as a policyholder.

This indicates that you will have more to pay of pocket if you experience a loss, however as a result, your month-to-month payment will be that much lower. Insurance provider believe if your deductible is higher, you will submit fewer claims. Deductibles often range anywhere from $250 to $1,000.

The Ultimate Guide To How To Lower Car Insurance Costs Without Losing Coverage

If you can afford the $1,000 deductible and will have the ability to pay that quantity out-of-pocket in the occasion of a mishap, it will definitely conserve you money on your insurance premium, somewhere around $201 per year or 10. 8% as a national average. Talk to your insurance provider to see what choices you have for your accident and detailed protection deductible.

It's possible to conserve money on your car insurance coverage when you spend less time on the roadway. With so lots of Americans working from home these days, commute times are absolutely nothing like what they utilized to be, and lots of people are driving much less as they shelter at home.

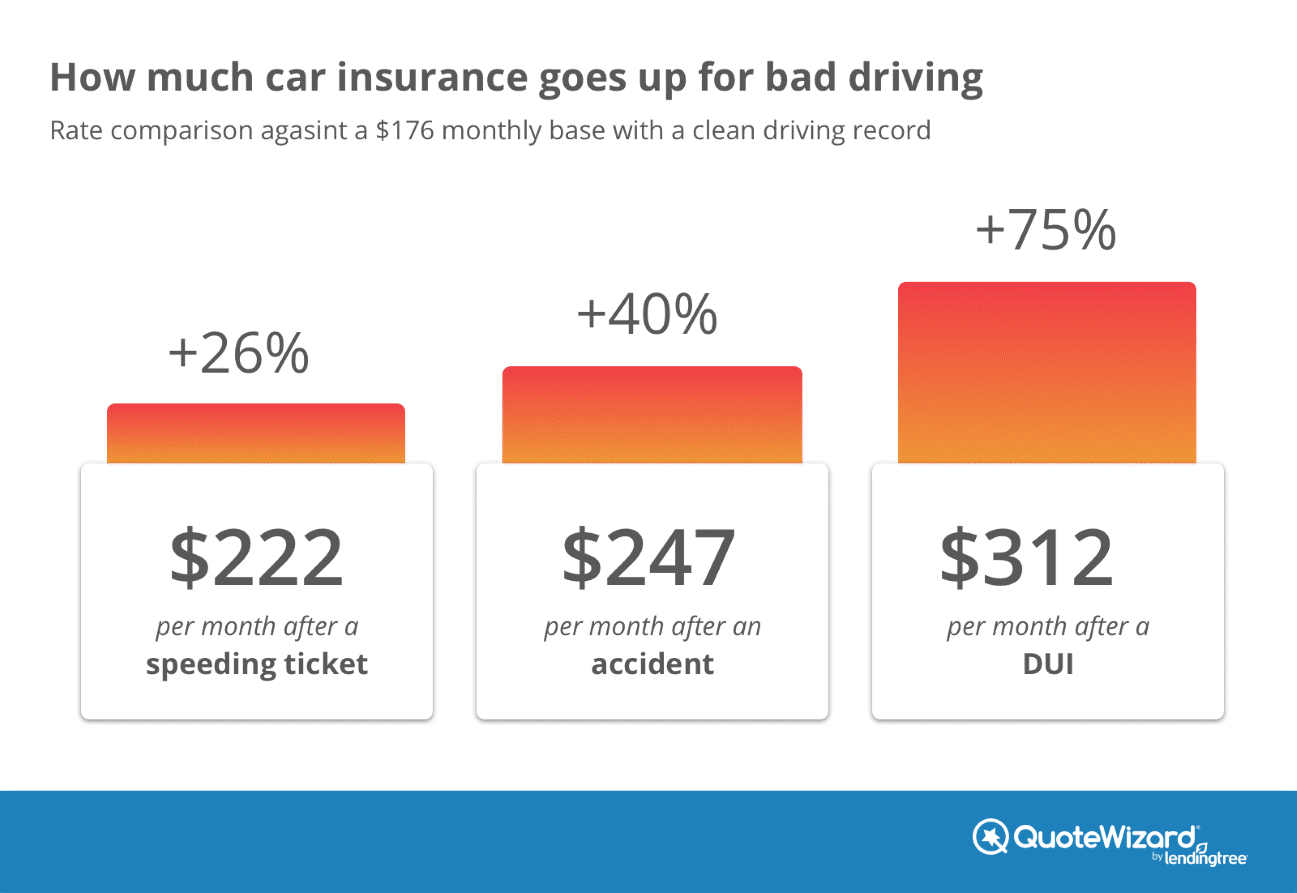

, rising by numerous hundred dollars in some cases. This only additional highlights the requirement to comparison shop so you can truly explore your choices and find the best-priced - and most flexible - insurance coverage service provider for your requirements.

Facts About How To Lower Your Car Insurance (Just 4 Easy Steps) - Ramit ... Uncovered

To assist, numerous insurance companies provide great trainee discount rates for teenagers who show duty through their academics. Parents and caregivers need to likewise think about multi-car discount rates, which are discounts that insurer provide when multiple members of the same household guarantee their cars together with the same provider. In a Summary: Times are hard and cash is tight today, thanks to coronavirus, however that doesn't indicate that you need to be stuck to costly insurance.

Prior to you purchase or restore your vehicle insurance plan, make sure to ask your insurer what type of savings programs they can provide you. In any case, it never ever hurts to shop your alternatives and see what discounts other insurance coverage companies can use you today based upon your home's needs.

** Automobile/Homeowners discount rate is available only to insurance policy holders who have both their automobile and house (or condo or tenants) insurance through the AARP Automobile & House Insurance Coverage Programs from The Hartford. The property owners product is not available in all locations, consisting of the state of Florida. Availability of Recover, Care benefit and advantage levels differ by state.

10 Easy Facts About Michigan's Auto Insurance Law Has Changed Explained

If you have frequent fender benders, think about paying for smaller repairs rather than filing a claim. Compare car insurance coverage rates from companies that provide safe driving discount rates to save some cash.

In other cases, taking some kind of "motorists ed" might even permit you to get some points taken off your license. Also, ask your vehicle insurer if they offer any discount rates for finishing a certified protective driving course. Each state has different requirements for these, so talk to your insurer to see which ones are authorized in your jurisdiction and to validate that investing in a course will translate into premium cost savings.

Ana Reina Automobile insurance coverage is a pricey and primarily unavoidable element to owning a vehicle. Making the best choices on them could help you conserve.

How How To Lower Car Insurance Rates: Uncommon Discounts can Save You Time, Stress, and Money.

8 suggestions to save money on vehicle insurance coverage, Much of these ideas take some time and work, but you'll be repaid with lower annual premiums, maybe for several years to come. 1. Obtain several quotes, Among the very best methods to minimize vehicle insurance is to compare quotes from several insurance provider.

As a guideline, big insurance carriers offer online tools that supply price quotes of how much you can expect to pay, depending on the protection limits you've chosen. These tools are just quotes, and might not paint an exact picture of what you'll in fact pay in the end.

It can likewise be valuable to ask family and friends for tips on insurance companies that have actually worked well for them in the past. Among the very best ways to pay less for car insurance coverage is by comparing car insurance quotes, Click listed below to start discovering your lower rate today from Progressive.

Shoppers' Guide - How To Lower Your Car Insurance Rates - An Overview

Look for bundling discounts, You can conserve cash by buying automobile insurance from a business with which you already have other types of insurance coverage, such as house insurance coverage. You may also be able to bundle your car insurance coverage with family pet insurance, if your company uses both.

If you presently have various insurance service providers for house and vehicle insurance coverage, you may be paying too much. Set up anti-theft devices, Depending on your insurance company, setting up a cars and truck alarm or a Lo, Jack could conserve you money depending on your insurance company.

https://www.youtube.com/embed/asG1vaxnMWw

The usage of your credit report as an aspect in determining premiums has actually been criticized by some consumer advocates, and is banned in California, Massachusetts and Hawaii. In all other jurisdictions, however, how well you pay your costs and other credit factors are likely to affect your car insurance coverage costs, even if you have a remarkable driving record.

AboutGetting My Teenage Driver Discounts - The Balance To Work

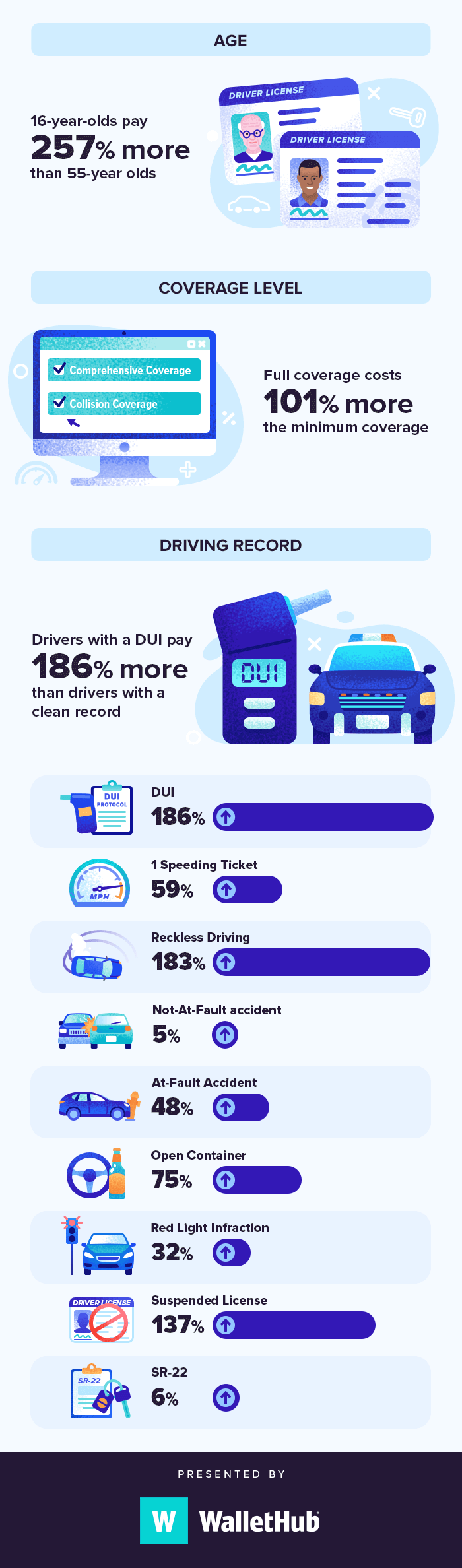

Guaranteeing a 16-year-old driver can be pricey. Given that teenager chauffeurs don't have the benefit of experience for insurance provider to think about when setting rates, they are considered riskier to insure. There are strategies you can use to assist in saving cash and get the best vehicle insurance for a 16-year-old motorist.

There is one location where moms and dads can score considerable savings: Choosing to include a 16-year-old to a family plan, which is typically less expensive, as opposed to having the teen get a private policy. Insuring a 16-year-old on an individual policy features an average increased expense of $1,947 per year.

Cheapest Vehicle Insurance Coverage for 16-Year-Old Males and Women, There is a difference when it concerns gender for insuring new teen chauffeurs. Normally, it costs more to guarantee a 16-year-old male driver than a female driver of the same age. That's because male motorists have a greater mishap rate and more insurance coverage claims and are for that reason more of a risk to insurance coverage business.

The Best Strategy To Use For Pros And Cons Of Having Your Own Teenage Car Insurance

Scroll for more While the least expensive average cost we discovered for including a 16-year-old to a household policy is $3,146, it costs an average of $5,318 for an individual policy for the same-age motorist. Simply by including a 16-year-old to a family policy, you can save approximately $2,172 each year.

Choosing to add one of these young chauffeurs to a household policy is one solid option to consider, which can conserve an average of practically $500 per year, even if you go with the cheapest alternative for either kind of policy. Compare Quotes for the Best Policy for Your Family, No matter the driver, when you're buying cars and truck insurance, comparing quotes can help you save.

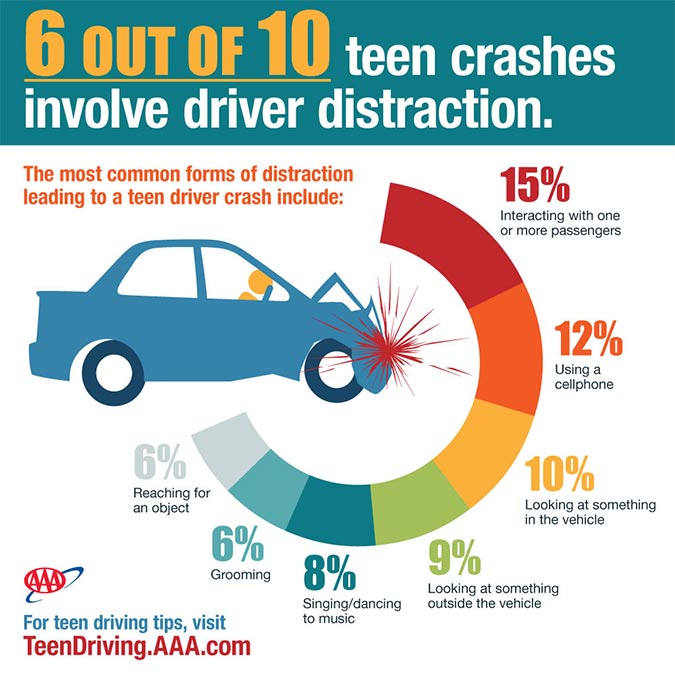

The more quotes you can get, the much better. Screen Your Teen Motorist to Ensure a Clean Driving Record, Just like chauffeurs of any age, guaranteeing your young chauffeur keeps a tidy driving record is a fantastic way to keep cars and truck insurance costs down. On the other hand, mishaps and tickets will significantly increase cars and truck insurance expenses for your 16-year-old.

What Does Five Ways To Save On Car Insurance For Teen Drivers Mean?

Lower the Protection Amount, The quantity of coverage you need will differ, however for those who want, reducing those can decrease the expense of insurance coverage business. You'll still have to comply with your state's minimum requirements, obviously, however lowering the protections can be a genuine option for those looking to save.

It's also important to be aware that by choosing this kind of coverage, you will not be covered for your own car damage or injury expenses. In the event of a crash, that might turn into an expensive issue if you do not have cash on hand to change or repair a trashed automobile.

For example, something like a Camry a four-door sedan that earned the top-safety choice from the Insurance Institute for Highway Safety will be a more affordable option to guarantee than a muscle car that concentrates on efficiency, like a Mustang. Sports automobiles and expensive luxury automobiles, in general, will be more expensive, too.

Little Known Questions About Five Ways To Save On Car Insurance For Teen Drivers.

Traffic Statistics for 16-Year-Old Drivers, The more youthful the motorist, the most likely it is that they'll be included in a crash. According to information for police-reported crashes in 2014 to 2015, drivers aged 1617 were included in almost double the variety of fatal crashes than 18- and 19-year-olds for every single 100 million miles driven.

Restricting the number of miles your teens drive could both assistance cut expenses and keep them safe. States With the Highest Cars And Truck Insurance Expense for a 16-Year-Old, Where you live will also impact your vehicle insurance rates, not just since the local statistics can affect expense, but also because you may have more minimal alternatives.

The day is finally here. Your teenager is getting their motorists license. It's a major milestone that will affect the household in many methods, some great and some not-so-great. Like when you include your teenager driver to your automobile insurance strategy and the monthly premium instantly balloons. While your rates are ensured to increase (teenagers are considered high-risk drivers), that increase does not have to spend a lot.

Some Ideas on How To Save Money On Car Insurance For Your Teen You Need To Know

Get a Better Rate With Multi-Vehicle Household Plans Will your teenager have their own automobile? If so, you might be questioning if they ought to purchase a separate policy. Many of the elements that enable you to get much better rates on your insurance coverage (think: being wed or having a good credit score) aren't applicable to your teen.

https://www.youtube.com/embed/lmRep5MXsB0

They can inform you which models will be the least expensive to guarantee. You can also have a look at this convenient calculator from to get a much better understanding of insurance premiums by vehicle make and model. Note: While older automobiles are usually more economical to fix, some insurer provide discounts for newer cars

AboutNot known Facts About How We Calculate Auto And Car Insurance Premiums - Usaa

Vehicle insurance based on mileage, at least in part, makes sense. The more you lag the wheel, the more chance there are of remaining in a vehicle accident. Nevertheless, it's just one of the common ranking elements cars and truck insurance provider take a look at. Even if you drive a lot there are numerous other ways to lower your vehicle insurance coverage rates.

Vehicles are a lot more than a need for many of us, a way of benefit, we have economically as well as emotionally bought our cars and trucks. And for this reason we do not think two times before protecting our automobiles with a cars and truck insurance plan. When the cars and truck insurance coverage premium surges every year and becomes dearer, that's when many of us experience doubt and doubt.

Here are a couple of factors, some of which are in your control that trigger your insurance premium to scale: Factors within your control: Driving routines: With distracted driving on the rise, it is not a surprise that the no. of mishaps are on the rise too. Defaulting on guidelines, not using a seat belt etc could cause problem not simply with the lawmakers but also your insurance coverage company that keeps a track of driving offences under your name.

The 25-Second Trick For Will Car Insurance Go Down At Age 25? - Car.co.uk Faqs

Number of claims filed: If you have a history of regular claims the insurer will deem you as a dangerous profile and hence charge you a greater premium. It is easy math, higher the threat more the premium. Make and model of your vehicle: Because the expense of the vehicle depends on the design, the insurance coverage premium rate will differ in between designs.

The IRDAI is accountable for the guideline of Third-Party car insurance coverage premium rates which are increased on an annual basis, thus increasing your vehicle insurance premium rate. Age of your cars and truck and the chauffeur: In a contrast as your automobile gets older your premium increases and the younger the driver the more premium you end up paying.

Deciding for an Absolutely no Devaluation cover with your insurance coverage strategy will help reduce your premium marginally. There are several other aspects that come into play in choosing the premium of your cars and truck insurance, to more on the factors and get the finest quotes on your premium click here. Opt for the one that is tailor made for your needs and fulfills your budget plan too.

Little Known Questions About Auto Insurance Premiums Explained - Aaa.

For more information, please describe policy wordings and prospectus prior to concluding the sales. This blog has been composed by A veteran in insurance coverage market. S. Gopalakrishnan is a name to reckon with in the field of reinsurance, he has actually headed the Reinsurance department and has abundant experience in other fields of motor insurance coverage.

If you're brand-new to the world of vehicle insurance coverage, you may be wondering: What are vehicle insurance coverage premiums? Essentially, it's what you pay your insurer in exchange for automobile insurance during each coverage duration. Everybody needs to pay premiums, however with the best supplier and discount rates, they don't need to be high.

If you're seeking to reduce your automobile insurance premium, the very best method to find the most affordable rates is to compare offers from a few extremely rated insurers. Our evaluation team has taken a close take a look at the finest car insurance companies in the market, and we'll offer you a couple of recommendations here.

Auto Insurance Rates Decreasing In 2021 For The First Time Can Be Fun For Everyone

If you have a poor driving record speeding tickets, past mishaps, traffic infractions or other incidents you will have higher rates for a set amount of time, generally around three years after each infraction. How often you drive can affect your premium rates. Numerous insurance companies provide usage-based discount rates for motorists that don't use their lorries frequently.

Your state likewise matters, as each state has different insurance regulations and required minimum protection. Younger motorists normally pay more for automobile insurance coverage.

In California, Hawaii, Massachusetts, Michigan, Montana, North Carolina and Pennsylvania, insurance companies are not enabled to base insurance coverage premiums on gender. In some states, having a better credit history means better auto insurance coverage rates. In California, Hawaii, Massachusetts, Michigan and New Jersey, insurance companies are not permitted to set rates based on credit rating.

12 Ways To Lower Your Auto-insurance Premiums - Kiplinger Fundamentals Explained

You may find that you can conserve a substantial quantity by switching insurance companies. Take a chauffeur security course: Lots of insurance companies offer discount rates for completing a state-approved motorist safety program. These courses are generally six or 8 hours, and some states mandate that insurance companies use discounts if you total one. Pick usage-based insurance coverage, if it might benefit you: Numerous insurance companies offer usage-based discount rate programs.

It can likewise occur if you include another motorist to your policy or if you receive a speeding ticket. Our suggestions for vehicle insurance If you're trying to find automobile insurance and desire to find the lowest cars and truck insurance premium, be sure to compare cars and truck insurance coverage prices quote from several providers. Use the tool below to begin, and consider examining out 2 of our highest-rated companies: Geico and USAA.

The list below factors are often considered when computing automobile insurance coverage premiums: car, driving history, driving practices, location, age, gender, credit rating and marital status. A six-month overall policy premium means that your selected cars and truck insurance coverage will be effective for six months after paying your premium. After six months, your insurance rate may be recalculated by your company and goes through alter.

The Basic Principles Of California Car Insurance Rates On The Rise - 21st.com

Completion outcome was an overall rating for each company, with the insurers that scored the most points topping the list. Here are the elements our scores take into consideration: Track record: Our research study group thought about market share, scores from industry specialists and years in organization when providing this rating. Availability: Automobile insurer with higher state schedule and few eligibility requirements scored greatest in this category.

The aspects that affect your car insurance coverage rates can appear like a total secret. Some of them are outside your control, like your age. However others are within your grasp, like paying your expenses on time, driving safely and looking around for the most inexpensive rates and they can save you numerous dollars a year.

(Some states ban the use of one or more of these consider insurance coverage rates, so they might not all apply where you live.)Your individual characteristics1. Your age, Young, unskilled motorists are most likely than older chauffeurs to have accidents. As a result, insurance coverage companies usually charge higher rates for motorists younger than 25.

Our How We Calculate Auto And Car Insurance Premiums - Usaa Statements

https://www.youtube.com/embed/RVg93XVoeb02. Your gender, In most states, insurers can charge different rates for male and female chauffeurs. This typically means rates for guys are higher when they're young, and rates for women are greater when they're older. A handful of states will not allow insurers to differentiate by gender. 3. Your marital status, The majority of large car insurer have lower rates for married motorists than for those who are single, apart, separated or widowed, research study by the Consumer Federation of America programs.

AboutInsurance Requirements - Scdmv Can Be Fun For Everyone

It's not too challenging to get car insurance coverage before purchasing a cars and truck. How can I approximate automobile insurance prior to buying a car?

If you are confused about how to buy automobile insurance, you remain in the ideal spot. In this post, we'll help you understand the basics of car insurance coverage, how much coverage you require, and how to start a policy. We'll reveal you a few ideas and techniques for how to get the most affordable cars and truck insurance coverage rates.

1. Understand The Various Kinds Of Car Insurance coverage Every state has different requirements for car insurance. In order to comprehend these requirements, it is essential to comprehend what each kind of cars and truck insurance covers. Let's have a look at the numerous types of protection for which you might register. Nearly all states mandate the following liability protection: With this coverage, the expenses connected to injuries or death that you cause to the other celebration are covered.

Some states will mandate the following protections, too: This protection compensates any medical expenses for your injuries or those of your passengers. With a PIP policy, you can also receive payments for lost wages and associated expenses. If a mishap is triggered by a motorist without insurance coverage, this policy covers the damages.

The 9-Second Trick For Cheap Car Insurance For Teens And Young Drivers - Compare ...

This strategy covers your expenses when the chauffeur that hits you does not have sufficient coverage. When you consider how to get car insurance coverage, there is a lot more than fundamental vehicle insurance coverage coverage to think about. Many chauffeurs purchase more than the state minimum to guarantee appropriate protection. You have the following options available to you: This coverage reimburses you for any damage done to your vehicle that arises from colliding with an item or another lorry, as long as you are at fault.

Lots of loan providers also need you to bring this protection when you owe money on a lorry. This optional protection provides you peace of mind if something need to malfunction while you are driving.

A state's minimum insurance coverage is offered in a series of three numbers. That breaks down to: $30,000 physical injury liability per individual $60,000 physical injury liability per accident $25,000 residential or commercial property damage liability per mishap While the needed level of insurance coverage is mandated by your state, it isn't constantly wise to go with the bare minimum protection.

Insurance protects your assets. If you exceed your protection limits and trigger serious injuries to someone, you will be personally liable.

The Greatest Guide To 7 Things You Should Know About Auto And Car Insurance - Nbc ...

If you already have an existing policy for renters or property owners insurance coverage, you might select to stick with the same company. The supplier will typically provide a discount if you bundle multiple policies, such as house and automobile insurance. Other than that, you must identify what kind of business you wish to deal with.

Collect All The Required Info Once you understand what type of protection you desire to buy, be prepared to share the following documents to buy automobile insurance coverage: Names for all drivers Dates of birth for all drivers Social security and chauffeur's license numbers Driving records, including any previous tickets or mishaps Lorry make, design, and year Lorry recognition numbers (VINs) for all covered vehicles Current mileage and usage of the lorry Call of the registered owner Address where you reside and where the automobiles lie Your present auto insurance policy information and expiration date You will likely want to answer any extra concerns asked of you to see if you receive discount rates prior to purchasing automobile insurance coverage.

Understand What Elements Affect The Expense Of Your Automobile Insurance While each company calculates the rate of its policies differently, here are a few fundamental factors to think about: This is among the most significant elements in the rate of your car insurance coverage. Speeding tickets, DUIs, and reckless driving all raise rates.

Generally, a greater rating correlates to lower rates, and individuals with lower credit scores typically report high vehicle insurance rates. A couple of states, Discover more such as California, have actually banned the usage of an individual's credit history when figuring out automobile insurance coverage rates. More recent motorists are charged greater rates, while chauffeurs with great deals of experience get a break.

The Facts About California Car Insurance Laws, Rates, And Quotes - Aaa Uncovered

If you reside in a largely populated area with many expensive claims, your insurance coverage will cost more even if you're a great motorist with a perfect history. More youthful motorists pay more, particularly teen motorists, as they have less experience. Teenagers can pay up to 2 or 3 times what a person in their 40s would pay.

Business like to see that you've had constant coverage throughout your driving profession. Gaps in protection can increase your rates.

That's a large range, which is why it's so essential to compare rates. If you are not exactly sure where to start, think about getting quotes from some of the best automobile insurance providers. 7. Select Your Automobile Insurance Deductible When it pertains to insurance coverage, a deductible is the amount of money you concur to pay toward covered repair work.

If you are seeking to conserve money, it makes sense to have high deductibles, as long as you have the cash to cover the expense must an accident happen. The higher your deductible is, the lower your premium will be. As you figure out the deductibles that work for you, think about these elements: Earnings Household spending plan Personal cost savings Readily available credit Make certain you only accept what you can actually manage.

Some Known Questions About Tips To Purchase A Car Insurance For The First Time.

Choose Your Cars And Truck Insurance Supplier Now that you have a number of quotes to compare, consider what other elements will impact your cars and truck insurance experience. Just because a business declares to have inexpensive cars and truck insurance coverage rates does not mean it provides the finest coverage.

https://www.youtube.com/embed/vfY0zv1M9tQ

Talk to the people closest to you about the companies they utilize. Discover out if claims have been paid and assess their satisfaction levels.

AboutThe Of Car Insurance - Raa

Take a protective driving course, Being an inexperienced driver makes you a greater threat for car insurers, which is why new chauffeurs tend to deal with higher rates.

In-person courses may be limited due to the pandemic, but you may be able to discover an online course instead-- one that's really more convenient for you anyhow.

You 'd believe that the more affordable an automobile is, the less it'll cost to guarantee, however really, older cars and trucks in bad condition might be more likely to break down or sustain damage in an accident than newer ones with upgraded safety features. When trying to find the most affordable vehicles to guarantee, aim to discover a car that remains in great shape and safe.

About The Best Cheap Car Insurance For 2021 - Money

You can even use a service like CARFAX to get information on a lorry you're believing about purchasing. Being a new driver suggests you'll likely pay more for car insurance-- but you don't necessarily have to pay a heap more. In addition to the suggestions above, make a point to go shopping around and get numerous car insurance prices quote.

Metromile puts you in the chauffeur's seat when it comes to your car insurance coverage since you spend for the miles you drive. When it comes to brand-new drivers, car insurer typically believe about 4 kinds of people:Teens who get their chauffeur's licenses while they're still in school, Adults who begin driving later on in life, Adults who might have a gap in their driving record due to the fact that they canceled their insurance coverage when they offered their automobile in the past, for example, Immigrants or others who are brand-new to the U.S.If you have less driving experience in the U.S.

When setting your rates, auto insurance provider look at things like your driving record and insurance history, consisting of how many years you've had your driver's license. If you're a brand-new motorist, you may not have much to reveal for yourself. Your years of experience as a chauffeur can be more essential than your age.

Ohio Auto Insurance - Cheap Car Insurance Quotes - Sr22 ... - An Overview

Insurance business focus on risk and whether certain groups of drivers may be more most likely to get into an accident when driving. It's not uncommon for some new drivers, such as teenagers, to pay more for vehicle insurance than knowledgeable motorists who have a speeding ticket, car mishap or even a DUI conviction on their record.

Whatever stage of life you remain in, you might not drive quite because you don't feel as comfortable behind the wheel or might not need to drive as much as a more experienced driver with more years of experience. Let's take a look at the numerous kinds of new chauffeurs who could save cash with Metromile.

Getting behind the wheel every now and then gives you a sense of flexibility, but you don't rely on your vehicle to get around. If you're in high school, you may be able to take the bus.

Rumored Buzz on Cheap Car Insurance ~ Get Affordable Auto Insurance - Geico

So with pay-per-mile insurance coverage, you could conserve money by spending for the miles you drive. If you begin driving later in life, insurers will still consider you a new driver, even if you are a little bit older. You might be a new chauffeur if your spouse utilized to do all of the driving, however you recently need a method to get around yourself.

And now they're moving somewhere else where they require an automobile to get to work and run errands. Whatever your situations might be, you might conserve cash with pay-per-mile insurance if you drive periodically. If you're seeking to go back to the driver's seat after an absence, you may be considered a new driver.

You might also be a brand-new motorist if you eliminated your vehicle when you moved to a big city. You might likewise wish to gradually ease back into driving due to the fact that you're used to navigating without a vehicle. So if you're putting less miles on your automobile than the majority of adults, you might most likely save money with pay-per-mile insurance.

The Definitive Guide for Best Car Insurance For Young Adults - Bankrate.com

might be thought about brand-new drivers. Even if you have actually driven your entire adult life in someplace else, you might not have a driving or insurance record in the U.S. It can often seem like going back to square one, as some insurer may consider you to have no driving experience or a automobile report they can think about.

Not only might you save big dollars by preventing the new price tag, however you might also decrease your costs by eliminating collision and extensive protection, which is developed to assist you replace or spend for repair work to your vehicle. The extra protection may include a deductible that's greater than the vehicle is worth.

Having a defensive driving class under your belt shows that you understand the guidelines of the roadway and how to react safely to dangerous scenarios when you're behind the wheel. It also shows an insurance provider you're taking actions to become a much safer chauffeur. In some states, Metromile offers discounts to drivers whose vehicles have certain safety functions and anti-theft equipment.

Cheap Car Insurance For New Drivers Under 21: What To Know Things To Know Before You Buy

New drivers pose a greater danger for insurance provider and for that reason are a lot more expensive to insure. To find the finest car insurance coverage for new motorists, we investigated every significant vehicle insurance provider and ranked them in locations like coverage, cost, and industry credibility. Here, we'll discuss the best vehicle insurance coverage for new drivers as well as how to get a policy, what you must learn about car insurance, and how to conserve cash on your premium.

Liberty Mutual offers the finest insurance coverage for new chauffeurs thanks to its cost effective rates and lots of discounts, including: If you're a trainee who has moved onto campus 100 miles or more far from house and did not bring the automobile to school, you might be qualified for a discount rate. Maintain higher than a B average to be qualified for this discount rate.

Liberty Mutual also has excellent ratings from industry experts like the Bbb (BBB), where the company holds an A+. This bodes well for Liberty Mutual's dependability and service practices. Given the discounts that could benefit young drivers, we think Liberty Mutual is the company with the finest vehicle insurance coverage for brand-new chauffeurs.

The smart Trick of New Drivers Car Insurance: Cheap Rates, Instant Online Quotes That Nobody is Talking About

https://www.youtube.com/embed/jkbTFxoFzU4As America's biggest automobile insurance coverage provider, State Farm has earned its reputation as one of the most relied on companies around and offers excellent automobile insurance coverage for brand-new chauffeurs. With a financial strength score of A++ from AM Best, brand-new drivers need to feel safe getting a policy with State Farm.

AboutThe smart Trick of Liability Vs. Full Coverage: Which Car Insurance Do You Need? That Nobody is

Car insurance coverage for young chauffeurs You have two options for covering your young motorists. You can add them to your policy, or you can buy a different policy for them. Including them to your policy is usually less expensive. Tell your company when someone in your family starts to drive or turns 16. If you don't tell the company, and the business finds out about them later, the company will bill you for the additional premium you ought to have paid. The business also might reject any claims you have or pick to not renew your policy. If your child does not have a car, you may be able to get a discount on your premium. If your kid is going to school in another state, examine the laws because state to.

make certain you have enough liability coverage. Understanding premiums Texas law needs insurance provider to charge rates that are fair, affordable, and appropriate for the dangers they cover. Insurance provider may appeal our choices. How do companies decide what to charge me? Insurance provider utilize a.

procedure called underwriting to decide whether to offer you a policy and how much to charge you. The amount you spend for insurance is called a premium. A lot of business think about these things when choosing your automobile insurance coverage premium: Insurer will charge you more if you have actually had actually mishaps or gotten tickets. Rates are greater if you reside in a city. This is since people in cities are more likely to have mishaps or have their vehicles stolen than individuals in rural areas. Rates can also vary in between postal code in the very same city. Collision and extensive rates are greatest for high-end, high-performance, and sports cars. Your rates will be greater if you drive your automobile to and from work or utilize it for company.

Some business utilize your credit rating to choose what to charge you. To discover which business use credit ratings, go to. Discover more: How your credit rating can impact your insurance rates Insurance coverage business inspect your claims history. turn you down, charge you more, or treat you differently than other individuals in your rate or threat class unless the company can reveal that you're a higher risk than others. turn you down or charge you more just since of your credit rating. Saving money on your insurance coverage Discounts assist reduce your premium. You might be able to get a discount rate if you have: airbags, anti-skid brakes, and antitheft gadgets in your automobile. finished a defensive driving or a driver education course. more than one automobile on a policy.

Get This Report on Car Insurance Coverage - Amica

State your premium is$100 a month and you paid for six months in advance.

A company needs to tell you in writing that it isn't going to restore your policy. A business can nonrenew your policy just after it's been in effect for 12 months. This indicates that if you purchased a six-month policy, the business can't refuse to renew it when the very first 6 months ends. It needs to restore it to offer you a full 12 months of protection.

If you still owe money on your vehicle, your lender will require you to have accident and extensive protections. TAIPA coverage is more costly than protection from other insurance coverage companies. Give this info to the insurance coverage business.

Some business might give you a list of preferred repair shops, however they can't require you to use a shop on its list. The insurance company is just required to spend for parts of like kind and quality to those that were damaged. What if the other driver's insurance coverage business refuses to pay my claim? If you believe the other motorist was at fault, however his or her insurance business will not pay your claim, sue with your own insurance provider. You need to have accident coverage to do this. Your insurance provider will probably try to gather from the other driver's company. Discover more: Were you in a mishap triggered by the other chauffeur? What if the other driver's limits aren't high enough to pay my expenses? If the other motorist's policy limits aren't high enough to pay for all your vehicle repairs, sue with your insurer. Your collision or uninsured/underinsured driver protection should pay the distinction. This implies the company will pay you to change your cars and truck rather than repair it.

If the company totals your car, it will pay your cars and truck's worth minus devaluation. If your car is 10 years old, the company will pay you the value of a 10-year-old secondhand cars and truck. Your insurance coverage business will pay for a rental car only for the time it thinks is affordable to fix or replace your car.

AboutSome Ideas on Auto Insurance You Should Know

You may wish to purchase a used car based upon your budget plan, however it's great to bear in mind how much reliability that used automobile has. If it's a little batter and you're not sure if it will begin in a few weeks, chances are it's not one of the very best first vehicles for teenagers.

Do other people tend to speak well of the automobile's performance and dependability? Design Although it may not be a life and death aspect, the design of automobile that you selected is essential, especially for your teen.

The smart Trick of The Keys To Defensive Driving (For Teens) - Nemours Kidshealth That Nobody is Talking About

Ask your kid what type of style they want and what they would try to find in a cars and truck. Use that info to choose out the finest vehicle for them. 9. Insurance When your teen begins driving, your car insurance is bound to alter. For numerous individuals this suggests their cost of insurance will go up.

You can also see about getting discounts from your insurance provider. Lots of companies will offer discounts or advantages to teenagers who have excellent driving records or take an unique course. Check out your choices and see what you can do. 10. Relieve of Driving Last but not least, you want to know how comfy and simple to drive the car is for your teenager.

Get This Report on Teen Driving - Auto Coverage From National General Insurance

Knowing what your teen wants in an automobile and likewise knowing what will be the safest option for them can help you make a smarter choice about which cars and truck will be the easiest and most safe to drive. Models to Consider Now that you understand what things to look for when buying a first car, here are some great starter vehicles for teens that you can take a look at: These are just a couple of ideas to get you began, however you should make your own list of vehicles that fit you and your teenager's needs.

Do you feel that parents having their teen kids handle the obligation of a huge purchase, such as a vehicle, provides a teachable moment that deserves the financial cost? Why or why not? A lot of the attributes that comprise what it means to be accountable, like self-control and delayed gratification, are still establishing during adolescence and into early adulthood.

The Ultimate Guide To Adolescent Sleep, School Start Times, And Teen Motor ... - Ncbi

These are also skills that can be trained and enhanced with practice, which implies that the teenager years are an excellent time to work out those self-control muscles, so to speak. Handling increased responsibility and autonomy with a vehicle can provide an adolescent with lots of possibilities to develop their self-discipline and postponed satisfaction abilities.

Having your teen pay for their automobile themselves (or at least contribute their own cash toward it) need to increase the worth they put on it, leading to safer and more accountable behavior. Some states forbid the use of gender to determine insurance rates, although the automobile death rate of male 16- to 19-year-olds is nearly double that of women of the exact same age.

Some Ideas on Driving And Teens - American Academy Of Child And ... You Need To Know

Women perceive a higher probability of unfavorable consequences and less pleasure from these actions than men do, which leads to less risk-taking behind the wheel. I anticipate these findings would play out similarly with adolescent young boys and women. That stated, analytical averages can't forecast the actions of any particular person; teens of all genders can be careless and risk-taking, and there are lots of teen kids who are incredibly safe motorists.

What is the mental difference between learning in the classroom and learning "on the road" as a driver? Something that shows up over and over once again in research with teenagers is a huge distinction in habits in between "cold" settings (nonemotional, intellectual contexts like a lab or a classroom) and "hot" settings (psychological scenarios in the real life, especially when peers and social pressure are included).

Fascination About What Percent Of Car Accidents Are Caused By 16 Year Olds

We asked Brandon, one of Dave Ramsey's suggested independent insurance coverage representatives in Montana, for some easy methods your teen can lower their vehicle insurance coverage rates. Get Hands-On Experience According to the CDC, automobile crashes are the leading cause of death for U.S.

What Does The Best Cars For Teenagers - Getjerry.com Mean?

"Driver's Chauffeur always helpsConstantlyAssists Brandon says. Strike the Books A lot of moms and dads have college on the brain when they encourage their kids to make great grades in school.

Here's how it works: You plug a device into your vehicle and drive around with it on your cars and truck for 3090 days. Insurance providers look at things like everyday mileage, tough brakes, fast acceleration and the time of day (or night) you driveall of which can affect your threat. For teenagers, that can be an incentive to pump the brakes and drive more securely.

Teen Driver Statistics Fundamentals Explained

Do Not Base Your Decision on Rate Alone We enjoy saving money as much as the next person, but you can't put a price on your child's safetyor, for that matter, your sanity. Here's the thing: Half of all teenagers will be associated with an auto accident prior to graduating from high school, according to the National Security Council.5 At some point, your teenager might be in a fender bender.

That implies having the ideal quantity of liability insurance and other protections to protect your teen. Plus, you'll want an advocate combating for your best interest throughout the claims process.

8 Simple Techniques For When To Take Your Child Off Your Car Insurance - Nationwide

There's no pitting you versus the adjuster. Simply excellent, truthful customer support through and through. "We're here in your community. Our kids go to school with your kids," Brandon states. "I see a lot of individuals who get irritated at a claim being denied because the captive or online representative isn't there for them.

Work With an Independent Insurance coverage Agent Naturally, dealing with an independent representative can be a money-saver too. That's because they're not restricted to a single service provider's options. With access to an entire network of insurance companies, an independent agent can help you find the very best coverage for your family for a cost that fits your spending plan.

The Facts About Can You Be 17 And Get A Car Loan? - Carsdirect Revealed

Lots of individuals who work with our advised pros conserve hundreds of dollars on automobile insurance coverage or get much better coverage for about the very same expense! Find your ELP today!.

https://www.youtube.com/embed/GBfxHhvTJw8

?.!!. The best cars for teens, or any new driver, need to likewise be the safest automobiles for teenagers, considering that protecting your teen driver is your first top priority. You'll likewise want an automobile that is both budget friendly and trusted. According to the National Center for Health Stats, automobile crashes are the leading cause of death among 15- to 20-year olds.

AboutWhat Does Gap Insurance For Your Vehicle - Protective Life Mean?

One insurer may offer lease and loan coverage for as little as $5 per month. It's probably safe to presume you will pay between $400 and $600, which covers the whole term of the loan.

With Reliable's partners, you can get rid of the lengthy part of your search.Maybe you didn't realize when you bought or rented your brand-new cars and truck that if you remain in a mishap and your automobile is a total loss, your insurer isn't obliged to settle your loan or lease completely. To make certain you are not paying too much for car insurance, it's complimentary to check online through Credible's partners.You may wish to think about space insurance if: The term of your automobileloan is 5 years or longer. You are paying a high-interest rate, making it hard to pay down the principal on your loan. GAP generally has a long definition, but all that space involves is extra insurance on a vehicle that covers the vehicle's value in between the quantity owed and what the lorry is worth. That might have still been a bit complicated, so we put together an example to explain the idea of GAP insurance coverage even further. See below for a figure revealing this example!. Space protection may assist. Gap insurance coverage pays your lending institution or finance business the distinction in between the worth of your amounted to lorry and the quantity you owe on your loan. Purchasing gap insurance coverage can be beneficial if the quantity you would owe in the event of an overall loss exceeds what your insurance provider would pay. That practically covers what gap insurance coverage does. Gap insurance coverage is not the same as brand-new automobile replacement insurance, where your insurance plan pays you based on the expense of replacing your car with a brand-new car of the same make and design. And it doesn't restore your car after a minor accident. Do You Really Need Gap Insurance? Space insurance coverage is a relatively little consideration when you're trying to pick the right insurance plan, but it's helpful to know what it is and when it's important. In many cases, you might be needed to carry space insurance coverage. When you rent a car, for example, gap coverage is typically folded into your lease payment. In truth, this insurance coverage only pays your lending institution or lease business for that"space" amount: If you do not have a space, you can't gain from this protection.

You may likewise decrease if covering the space out of your savings would be simple for youand you're comfortable that the danger of totaling your cars and truck is low. According to the Insurance Coverage Info Institute, your cost might be as low as $20 each year. Some auto insurer don't offer space insurance coverage.

Some Known Details About Gap Insurance Coverage And How It Works - Autoaccident.com

If your insurance carrier does not offer space coverage, you may have to shop around for it. You can either get prices

on standalone gap insurance or insurance coverage for store on your complete auto insurance automobile insurance coverage compare rates. Space(Guaranteed Possession Security)insurance coverage, also understood as loan-lease payoff coverage uses automobile owners important monetary defense in their automobile's early age.

The 15-Second Trick For Gap Insurance - What Is It, What Does It Cover & How ... - Aaa

https://www.youtube.com/embed/YtNU0YRXtkQWhen you have a loan or a lease on your car, getting space insurance coverage may be an efficient method to conserve money. How Does Space Insurance Coverage Work? Let's state your cars and truck gets amounted to by a covered occurrence like theft, a mishap, typhoon, flood or vandalism. If you have thorough or accident insurance, your insurance company will pay the real money worth of your vehicle at the time of the hazard. If it occurs in the early years of your car's life, this amount will be reasonably less than the amount you still owe on your car loan or lease. Just How Much Does Space Insurance Coverage Expense? Usually, gap insurance can cost you around $20 a year, if you purchase it from an insurer and bundle it with your collision or detailed protection. If you purchase it from a lender or a dealer, you may need to pay a one-time fee of about$500 to$ 700. Likewise, if your loan period is four to 5 years, you need to think about getting gap insurance. For those who lease a car, space insurance coverage is a must. In fact, lots of lease arrangements consist of gap insurance in the agreement itself. Another great time to purchase gap insurance is when the vehicle you have actually bought tends to lose its worth much faster than other automobiles. Check out this site The time it requires to place your rearview mirror has to do with the same quantity of time it takes for your brand-new car to start losing its value. Your automobile starts to depreciate so rapidly that if it's involved in a mishap or taken prior to you have actually settled the loan, you might owe more than the auto deserves. What is GAP"insurance"and what does it cover? GAP protection frequently referred to as GAP insurance coverage is an optional, add-on policy that can help you cover the gap in between the worth of your vehicle and what you owe on your Brand-new Vehicle Loan or Utilized Vehicle Loan in case of a loss. Why you might require GAP insurance protection space insurance can secure versus overall loss if you're still making payments on your automobile, since the extensive section of your basic car policy just pays what your cars and truck is worth at the time of loss. According to the Insurance Details Institute , you could also gain from GAP coverage if you bought a vehicle that diminishes faster than average vehicles, like a luxury vehicle, or if you rolled over an auto loan where you were upside down on the payments.

AboutThe Greatest Guide To Your Guide To Understanding Auto Insurance In The ... - Nh.gov

By doing so, you might keep the plates on the vehicle up until it is sold and stay in compliance with the law. Following the sale of your lorry, you should bring your plates in and either position them on "hold" up until you are prepared to use them again or cancel them.

There are lots of car insurer out there, and no two are alike. The factor we encourage you to compare them is to ensure you're getting the best offer for you, however we're likewise wanting to conserve you time. Every company has a various website with a different quote process, ask for different info and offer you prices estimate in different ways.

Some Known Details About How Long Does It Take To Get Car Insurance? - Wallethub

It's not as fancy, but it pays the expenses. I have great credit, have car insurance, and have actually been insured by the very same business (Erie Insurance coverage) for the last three years. I have had 3 occurrences in the last 3 years 2 speeding tickets (more than 10 however less than 20 miles over the published speed limit) and one accident that was my fault (I struck a vehicle in a crossway.

About This Article The goal was to go through the quote procedure for a number of cars and truck insurer to see what it requires to get a quote. Each quote procedure was timed with a stop-watch, so it doesn't take into account any time I might have invested talking with my coworkers or making coffee or responding to emails.

The Facts About How Long Does It Take For Auto Insurance To Kick In? Uncovered

Insurer desire a great deal of details, and various companies ask the very same questions in various methods. I had my accident history and insurance coverage information useful since I made it up; if you're a real person with a real driving record (most likely you are) you want to have that details ready so you're not rushing to find the answers while your session times out.

Some things to get ready in advance: Existing insurance provider, how long you've been with them, what your protection levels are, and when your policy ends. State minimums for where you live.

How Getting A Driver License: Mandatory Insurance - Dol.wa.gov can Save You Time, Stress, and Money.

The below conversations are by no means extensive, but they do highlight some of the differences. Progressive Progressive's CJ is all about the add-ons. The first thing they asked was if I wanted to bundle my auto insurance coverage with my house and life insurance (I said no). Prior to they 'd give me my quote, they informed me about Snapshot and asked if I wanted to enlist in that program (I didn't).

/car-repair-following-insurance-claim-accident-527113_color-e5cd60eaed274db5b5e65c860183cd64.png)

As you edit choices, the rate changes in real time, so you can see how various choices impact your bottom line. As soon as you've chosen, you have a lot more choices pay in full or in installations? After they show you the quote, they need a little bit more information (this is quite standard) my VIN, license number, etc.

Not known Facts About Car Insurance - Get A Free Auto Quote

My rate visited about $10 a month after they examined their "reports" which was intriguing, given that Ms. Brooks doesn't exist. They took me to a pay portal and provided me a. pdf of the policy to e-sign. Allstate Allstate wanted more details from me than some other companies what I do, what part of the city I reside in however it did take the initiative and compute my annual commute for me, which was appreciated.

There were all sorts of discount rates provided to me, some of which I had to choose into and some of which were subtracted instantly. The design of the quote was easy to understand, and the side-by-side comparison of the bundles used was valued.

The Definitive Guide for How Long Does It Take For An Insurance Company To Pay Out ...

GEICO In addition to the questions other business asked, GEICO would like to know specifically what I provided for a living, and if I 'd been a federal government staff member, they would have asked what GS level I was (that is, what my salary is). This doesn't look like that ought to be pertinent details for my insurance provider, but provided GEICO's roots in guaranteeing civil servant, maybe there's a reason for it.

If I were the sort of person who repented of my made-up accents, I would have been additional upset at this repeating. GEICO knew what the minimums were in my state and the dropdown to choose my coverage level didn't use me less than that. When it pertained to discount rates, however, they just offered me affinity group discounts, and when it came time to pay, there was no benefit to paying in complete in advance.

The smart Trick of Florida Insurance Requirements That Nobody is Discussing

The first page was the discount rate page, which put me in an excellent state of mind with its joyful drifting graphics and guarantees of a lower rate. Esurance didn't require as much detail about my violations as the other websites (didn't appreciate dates, for instance), however they did would like to know if I had a Pay, Pal account, which I thought was a little unusual.

The quote was clearly displayed and the choice to tailor the policy was instant and apparent. They likewise gave me the chance to compare to other business clicking the links took me to the competitors' pages, where I would have needed to start over if I desired to see a quote.

6 Simple Techniques For How To Get Same-day Car Insurance - Valuepenguin

Farmers gave me one quote, with no modification choices. I could change my coverage levels, so I played with that for a while. It revealed me just how much each aspect of my coverage (Physical Injury, Property, Uinsured Motorist, etc) was costing me, and let me modify those worths and recalculate my policy.

There was no mention of comparing to other business. Of all the websites I checked out, Farmers was the least easy to use, but it still did its task and provided me an insurance coverage quote. State Farm State Farm made me a great deal of deals their "Drive Safe & Save" program, individual property and occupants insurance and a whole panel of discount rates all situated on the very same page.

Rumored Buzz on Nine Ways To Lower Your Auto Insurance Costs - Iii

The General The General didn't request my surname till after I saw the quote, which probably makes people feel more safe. The first thing I saw about The General was among those "chat with a genuine life person" bubbles that are all the rage nowadays. Some other websites had them, but this one scrolled backward and forward across my screen until I told it to stop.

https://www.youtube.com/embed/Wm6yFaUkFgI

The way the quote information existed was a little confusing, and their "compare other companies" page didn't provide me anymore info than to link me to other insurer in my area. Once I 'd seen the quote, they wanted more details surname, gender, e-mail and street address, plus the basic concerns about the automobile.

AboutExamine This Report about How Long Does An Accident Stay On Your Insurance

In addition to immediate damage to your lorry and prospective injuries, cars and truck mishaps can likewise have lasting financial impacts. They'll often increase vehicle insurance premiums, and the boost can last for numerous years. Simply put, accidents can increase insurance premiums for up to nine. Not just does an exceptional boost raise insurance coverage costs, but numerous accidents can increase the monetary problem as their premium increases compound.

If you've remained in a mishap, here's how your cars and truck insurance coverage rates may be affected and what you might be able to do about it. How Automobile Accidents Can Impact Insurance Rates A vehicle accident might lead to your automobile insurance rates going up after the mishap. As with lots of other elements of car insurance in Canada, nevertheless, exactly how your insurance coverage is affected depends upon a range of factors.

If you are at fault, the premiums may still remain the exact same if you have not submitted an insurance claim just recently and the quantity of this claim is fairly minimal. In case your premiums increase, the boost typically does not enter into effect up until your policy renews (or you alter policies).

The 2-Minute Rule for What Is Accident Forgiveness? - The Hartford

Need to you be in several mishaps within three years, the associated premium additional charges will likely stack on each other. This is what can make insurance especially costly if you remain in more than one accident in a short amount of time. In summary, after an accident you can most likely anticipate the following to take place: Your cars and truck insurance coverage rates might stay the same if you're not at fault, have a tidy driving record or remain in just a minor mishap Your insurance coverage rates might increase if you're at fault as the insurance provider evaluates an additional charge Any additional charge you see will most likely enter into impact at your next policy renewal.

Depending on the business, it will last as much as nine years What's No-Fault Insurance coverage? No-fault insurance is a system that's designed to make cars and truck insurance coverage in Canada more budget-friendly and declares processing after an accident simpler. With no-fault car insurance, after an accident, fault has no effect on what insurance company chauffeurs collect compensation from.

As a wrap-up, no-fault insurance is a system that simplifies insurance claims. With this system: You deal with your insurance coverage provider if you have an accident claim Your insurance coverage carrier offers settlement according to your policy's coverages You might still be discovered at fault for an accident Your insurance coverage rates can still increase after a mishap Automobile Insurance and Changes in Driving Record Premiums for vehicle insurance coverage in Canada are based partly on your driving record, and any modification in your driving record might affect your car insurance coverage rates.

Not known Details About How Much Does Insurance Go Up After Accidents?

Your driving record generally goes back three years, and it'll usually reveal tickets, mishaps, claims, convictions, and finished driver's education courses. Whenever any of these occasions, consisting of an auto mishap, go on your driving record, they can have an effect on your automobile insurance coverage rates. The majority of will result in a surcharge that lasts three years.

In the majority of scenarios, an authorized driving course will lead to a superior decrease-- and one might help alleviate the impacts of a mishap or other occurrence. To summarize your driving record: A driving record normally shows three years of driving-related events Most events will lead to a three-year additional charge that's contributed to your premiums You may be able to reduce premiums by completing an authorized driving course Are you covered? Get your automobile insurance coverage quote today.

Does a car accident impact your driving record? How an accident that's listed on your driving record impacts your automobile insurance rates depends on the specifics of the mishap.

More About Will My Insurance Rates Go Up If I Get In A Car Accident?

Everyone knows that an at-fault accident impacts how much you pay for auto insurance. But for how long? Technically, it remains on your record forever, but the majority of companies utilize it for six or 9 years to determine whether they want to guarantee you at all, and if so, to help set your premium.

Insurance coverage business utilize dozens of various pieces of info about you, your car and your driving history to figure out how most likely you are to make claims and how costly those claims are most likely to be. Typically described as score aspects, these data points are then used to show up at your last car insurance premium.

The length of time Does the Accident Stay? An at-fault mishap technically remains on your driving record permanently. The majority of insurance coverage companies will utilize it as a score element for six or 9 years, and some will utilize it for as much as 25. That clock starts ticking the 2nd the mishap occurs. On the other hand, insurance companies can only use tickets as a score aspect for 3 years, but that clock begins ticking on the conviction date.

How Long Does An Accident Stay On Your Record In Ny? Can Be Fun For Anyone

So if you get in an accident and are charged as an outcome, the timeline for the ticket usually won't be the exact same as the timeline for the at-fault mishap. Who Decides If I'm At Fault? Every time your car is associated with a mishap, your insurer will investigate it based information from cops or the crash reporting centre.

These guidelines ponder every possible accident circumstance, and spell out which motorist is at fault in each one. In some cases, 2 or more motorists can be found to be partly at fault for the exact same mishap.

If you disagree with your insurance provider's determination of fault, you can appeal the choice to the company's ombudsman. If you do that and still disagree with the outcome, you can take the matter to the province's ombudsman. Important note: If you get in a minor car accident and do not report it, it can still go on your record as an at-fault mishap if another person reports it.

Car Insurance Rates After An Accident Can Be Fun For Everyone

If you have more than one at-fault, your premium can triple or even worse. If you likewise have tickets on your record, that can make it even problematic for you to discover cost effective insurance. A lot of companies won't increase your premium in the middle of the policy, but you will pay more on renewal.

This perk is usually only provided to motorists with clean driving records. If your policy includes mishap forgiveness, that indicates that your first at-fault accident (within a six-year period) will not count versus you in terms of how much you spend for auto insurance. If you then get in another at-fault accident within those 6 years, that second mishap will count as your first, and so on.

https://www.youtube.com/embed/gCiQxC3J9Yo

If you have a claim any time in the future and it comes out that you lied about your driving history, your claim might be denied and you might be cancelled for misstatement, which will impact your premium a lot more severely than an at-fault accident. The finest policy, as your mommy taught you, is to always tell the reality.

AboutA Biased View of Can't Keep Up With Insurance Premiums? Here's What To Do

You require space insurance coverage if there is undoubtedly a gap between what you owe and what the cars and truck is worth on an utilized cars and truck lot. That is more than likely to occur in the very first number of years of ownership, while your brand-new automobile is diminishing quicker than your loan balance is diminishing.

What Does Space Insurance coverage Do? Think about it as an extra insurance plan for your car loan. If your automobile is wrecked, and your detailed automobile insurance coverage pays less than you owe the loan provider, the gap policy will comprise the distinction. How Do I Get Gap Insurance? The most convenient method, and probably the least expensive method, is to ask your automobile insurer if they can add it to your existing policy.

Your finest bet is to call your vehicle insurance coverage company and ask whether you can include it to your existing policy. Your insurance company should be able to tell you what your options are and how much adding gap protection might cost.

Specifically, automobile gap insurance is sensible for those with substantial unfavorable equity in a vehicle., not paying for gap insurance when you do not actually require it is one way to save some money.

Some Known Facts About Auto Insurance Guide - Minnesota.gov.

The penalties for driving without insurance in Michigan are the harshest in the nation. Uninsured drivers deal with fines, chauffeur's license suspensions and even prison time. If there is a car mishap, they can not sue, even when injured and totally innocent, and they will even need to repay the insurance coverage business of the irresponsible chauffeur.

I understand that this concern poses a very tough dilemma: for too many people, it is actually a choice of paying for cars and truck insurance coverage or spending for groceries or rent. As agonizing as this option can be, the truth is that no one can manage to be driving without insurance in Michigan.

Even before the economy crashed, more people than ever were driving without automobile insurance. In cities like Detroit, Flint and Fight Creek, it is approximated that more than 50% of motorists do not have insurance. There are extremely major penalties for driving without insurance coverage in Michigan. These penalties leave you specifically vulnerable if you are ever injured in a serious car mishap.

(MCL 500. 3102( 2 )) If you are founded guilty of driving without insurance in Michigan, you "will be fined not less than $200. 3102( 2 )) If you are founded guilty of driving without insurance coverage in Michigan, you "shall be.

What Happens If I Miss My Car Insurance Payment? Can Be Fun For Anyone

If you are driving your own uninsured lorry and you are included in an automobile mishap, then you might be legally needed to spend for the medical expenses of anyone who was hurt consisting of those of the at-fault motorist, even if he or she 100% at-fault, ran a red light, was speeding, intoxicated, drugged, and texting at the time of auto accident.

3177( 1 )) Failure to pay could lead to suspension or cancellation of your chauffeur's license. (MCL 500. 3177( 1 )) For the exact same reasons you may be required to pay for other individuals's medical expenses, you may be needed to pay for their lost incomes if you were driving without insurance coverage at the time you were included in an automobile accident.

You will need to compensate the car insurance coverage business of the irresponsible, at-fault motorist for whatever they pay out in No-Fault medical and wage loss advantages (and survivor's loss advantages if somebody was killed in the cars and truck accident). This can imply you are potentially responsible to following persons and/or their estate, if somebody was killed as a result of an automobile mishap: Travelers in your lorry, Drivers of other vehicles, Passengers of other automobiles, Motorcyclists, Bicyclists, Pedestrians The law in Michigan quite actually rubs salt in the wound.

When I speak at workshops to vehicle mishap lawyers in other states, they literally are amazed at just how oppressive and punitive the law remains in Michigan. This is why I composed above that people who think they can not pay for cars and truck insurance coverage are the exact same people who actually can't pay for not to have cars and truck insurance coverage.

Not known Details About Car Insurance For First-timers